Glassnode analysis reveals that Ethereum addresses in profit have declined to 53.5% due to Ether’s recent 13% price drop, with potential for profit fluctuations pending significant market events.

Key Points

- Glassnode analysis shows Ethereum addresses in profit dropping to 53.5% due to Ether’s 13% price decline in the past month.

- Last time it fell below 54% was on January 12, 2023, with fluctuations noted during 2022 and early 2023.

- Ethereum’s current price hovers around $1,600 amidst market uncertainty, awaiting catalysts like Fed policy changes or a spot Bitcoin ETF for a potential rally.

- Ethereum’s profitability may shift based on market volatility, with positive developments or sentiment changes impacting holders’ profits.

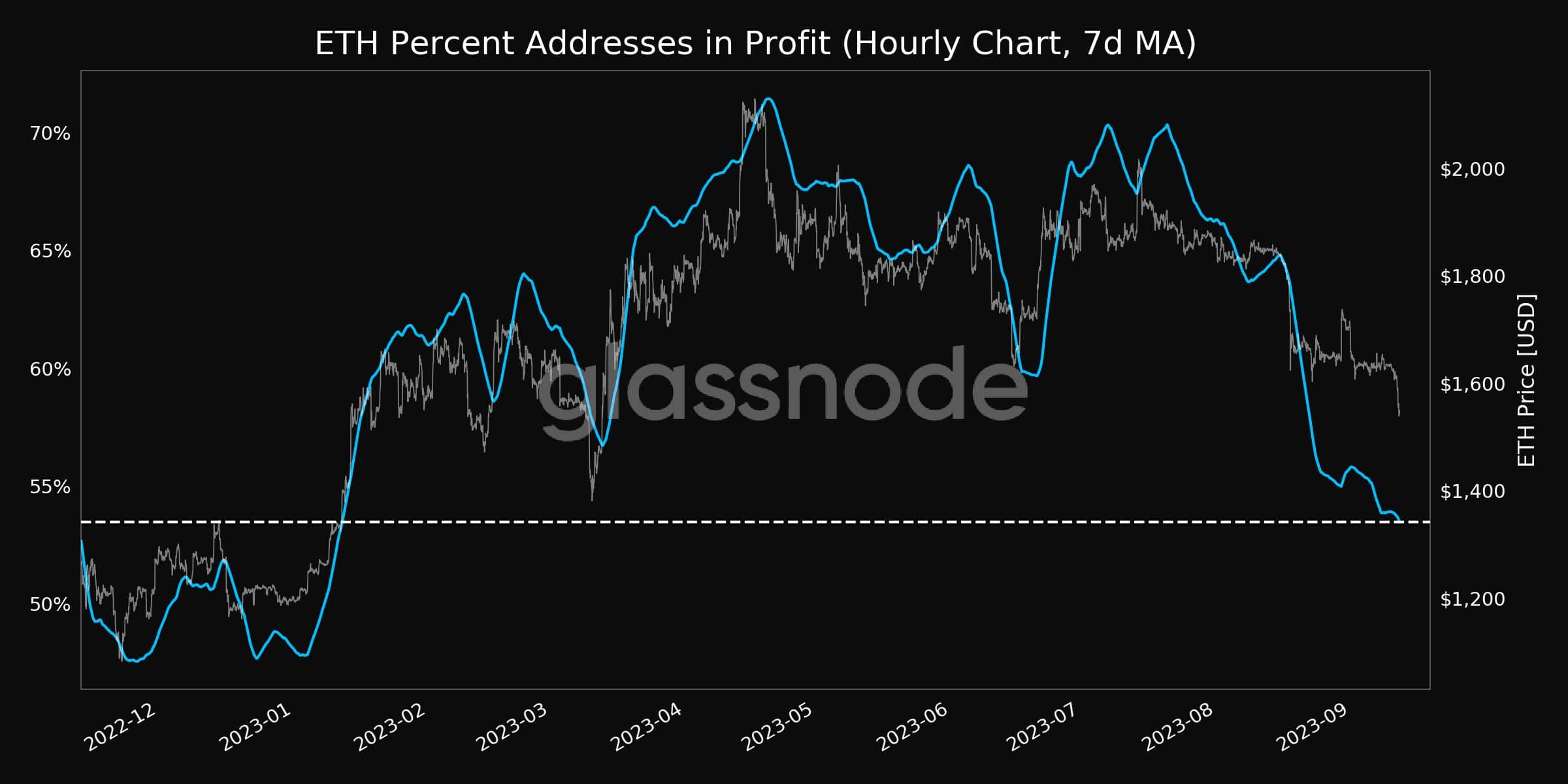

A recent analysis by blockchain intelligence platform Glassnode reveals that the percentage of Ethereum addresses currently in profit has decreased to approximately 53.5%. This decrease is primarily attributed to the declining market performance of Ether, which has experienced a price drop of around 13% over the past 30 days.

#Ethereum $ETH Percent Addresses in Profit (7d MA) just reached a 8-month low of 53.462%

Previous 8-month low of 53.483% was observed on 12 January 2023

View metric:https://t.co/BUbkntqvVb pic.twitter.com/bdzGGGtm4S

— glassnode alerts (@glassnodealerts) September 12, 2023

Last Occurrence of Below 54% Profit Addresses on Ethereum

Glassnode estimates that the last time Ethereum addresses in profit fell below 54% was on January 12, 2023. During the end of 2022 and the beginning of this year, the percentage was even lower. However, the figure had significantly increased above 70% in May when ETH approached the $2,000 price mark and again in July when it reached that milestone.

Ethereum Consolidates at $1,600 Amidst Market Uncertainty

Currently, Ether’s valuation has stagnated at approximately $1,600 and is awaiting significant developments to indicate a revival. The cryptocurrency market as a whole is in a similar state, waiting for events such as the Federal Reserve’s shift in interest rate policy, a favorable outcome for Ripple in its lawsuit against the US SEC, or the official approval of a spot Bitcoin ETF in the United States, which could potentially trigger a bull rally.

If any of these events occur in the near future, it is possible that the overall percentage of ETH addresses in profit may spike well above the 70% level. However, if the bearish trend continues or intensifies, the number of Ethereum addresses experiencing paper losses may increase.

Concluding Thoughts

The current trend suggests a decrease in profit for Ethereum addresses, primarily due to the recent decline in Ether’s market performance. However, the cryptocurrency market is known for its volatility, and any significant positive developments or shifts in market sentiment can quickly change the profitability landscape for Ethereum holders.